-

TRADING

TRADING PLATFORM

Account type

Margin requirements

- TRADE RESOURCES

- INSTITUTIONAL SERVICE

- ABOUT

Imagine this scenario. Price starts to rise. Keeps rising. Then it starts falling. And falling some more. And then it starts going back up.

This is called the “Smooth Retracement!”

In the above example, the forex trader failed to recognize the difference between a retracement and a reversal.

Retracements are temporary price reversals that take place within a larger trend. The key here is that these price reversals are temporary and do not indicate a change in the larger trend.

Notice that, despite the retracements, the long-term trend shown in the chart below is still intact. The price of the stock is still going up. When the price moves up, it makes a new high, and when it drops, it begins to rally before reaching the previous low. This movement is one of the tenets of an uptrend, where there are higher highs and higher lows. While that is occurring, the trend is up. It is only once an uptrend makes a lower low and lower high that the trend is drawn into question and a reversal could be forming.

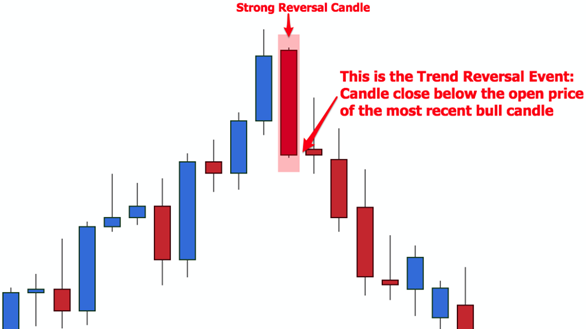

A reversal, on the other hand, is when the price trend of an asset changes direction. It means that the price is likely to continue in that reversal direction for an extended period. These directional changes can happen to the upside after a downward trend or the downside after an upward trend.

Most often the change is a large shift in price. However, there may be pullbacks where the price recovers the previous direction. It is impossible to tell immediately if a temporary price correction is a pullback or the continuation of the reversal. The change can be a sudden shift or can take days, weeks, or even years to materialize.

The moving average (MA) and trendlines help traders to identify reversals. Intraday reversals are important to day traders, but longer holding funds or investors may focus on changes over months or quarters. As shown on the image below, when the price drops under the MA or a drawn trendline, traders know to watch for a potential reversal.

Properly distinguishing between retracements and reversals can reduce the number of losing trades. Classifying a price movement as a retracement or a reversal is very important.

There are several key differences in distinguishing a temporary price change retracement from a long-term trend reversal. Here they are:

|

|

|

|

|

|

|

|

|

|

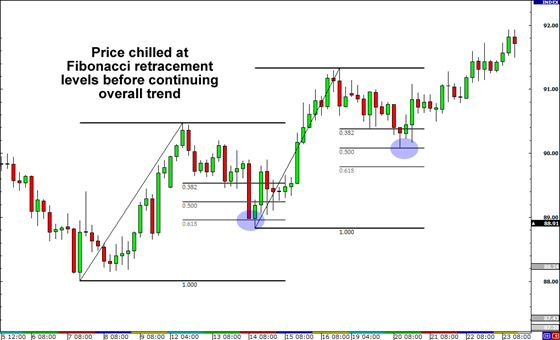

A popular way to identify retracements is to use Fibonacci levels. For the most part, price retracements hang around the 38.2%, 50.0% and 61.8% Fibonacci retracement levels before continuing the overall trend. If price goes beyond these levels, it may signal that a reversal is happening. Notice how we didn’t say will.

In this case, price took a breather and rested at the 61.8% Fibonacci retracement level before resuming the uptrend. After a while, it pulled back again and settled at the 50% retracement level before heading higher.

Another way to see if price is staging a reversal is to use pivot points. In an UPTREND, traders will look at the lower support points (S1, S2, S3) and wait for it to break. In a DOWNTREND, forex traders will look at the higher resistance points (R1, R2, R3) and wait for it to break.

The last method is to use trend lines. When a major trend line is broken, a reversal may be in effect. By using this technical tool in conjunction with candlestick chart patterns discussed earlier, a forex trader may be able to get a high probability of a reversal.

*The information presented above is intended for informative and educational purposes, should not be considered as investment advice, or an offer or solicitation for a transaction in any financial instrument and thus should not be treated as such. Past performance is not a reliable indicator of future results.

Online Chat Chat with us

Email:supportsohomarkets.cc

Copyright © 2024 - All rights reserved.

Soho Markets Global Limited is an Investment Firm incorporated under the laws of Republic of Mauritius under number 181778 and registered address at Suite 803, 8th Floor, Hennessy Tower, Pope Hennessy Street,11328, Port Louis, Mauritius. Regulated by the Financial Service Commission (FSC) in Mauritius under license number GB21026599.

RISK WARNING: Soho Markets Global Ltd offers trading on Foreign Exchange (‘Forex or ‘FX) and Contracts for Difference (‘CFDs), which are complex financial products that are traded on margin. They carry a high level of risk since leverage can work both to your advantage and disadvantage. As a result, these products may not be suitable for all investors, as loss of all invested capital may occur. You should not risk more than you are prepared to lose. Before deciding to trade, you need to ensure that you understand the risks involved and consider your investment objectives and level of experience. Seek independent advice, if necessary.

Soho Markets Global Ltd does not issue advice, recommendations or opinions in relation to acquiring, holding or disposing of a CFD.

Soho Markets Global Ltd is not a financial advisor and all services are provided on an execution-only basis. This communication is not an offer or solicitation to enter into a transaction and shall not be construed as such.

This website is not directed at any jurisdiction and is not intended for any use that would be contrary to local law or regulation.

By using our you agree to use our cookies to enhance your experience.

Services are not available for residents of Turkey and United States of America

Telephone: +230 2146398

CLIENT AGREEMENT (TERMS AND CONDITIONS) Complaints or Grievances Policy Conflicts of Interest Policy Cookie Policy Order Execution Policy Privacy Policy Risk Disclosure