-

TRADING

TRADING PLATFORM

Account type

Margin requirements

- TRADE RESOURCES

- INSTITUTIONAL SERVICE

- ABOUT

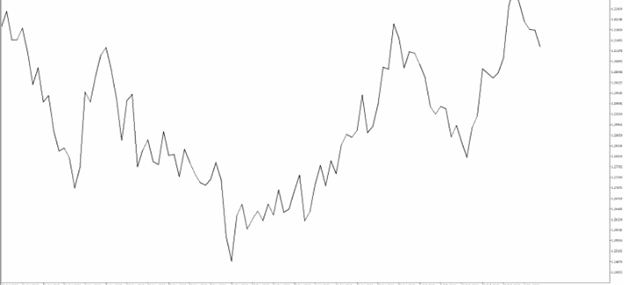

A line chart connects the closing prices of the timeframe you are viewing. So, when viewing a daily chart the line connects the closing price of each trading day. This is the most basic type of chart used by traders. It is mainly used to identify bigger picture trends but does not offer much else unlike some of the other chart types:

An OHLC bar chart shows a bar for each time period the trader is viewing. So, when looking at a daily chart, each vertical bar represents one day's worth of trading. The bar chart is unique as it offers much more than the line chart such as the open, high, low and close (OHLC) values of the bar.

The dash on the left represents the opening price and the dash on the right represents the closing price. The high of the bar is the highest price the market traded during the time period selected. The low of the bar is the lowest price the market traded during the time period selected.

2. The red bars are known as seller bars as the closing price is below the opening price.

In either case, the OHLC bar charts help traders identify who is in control of the market - buyers or sellers. These bars form the basis of the next chart type called candlestick charts which is the most popular type of forex charting:

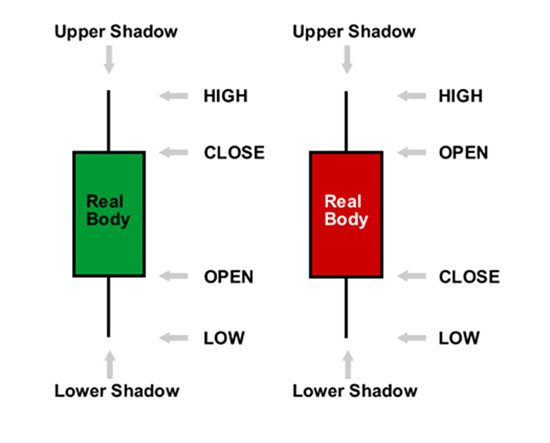

Candlestick charts were first used by Japanese rice traders in the 18th century. They are similar to OHLC bars in the fact they also give the open, high, low and close values of a specific time period. However, candlestick charts have a box between the open and close price values. This is also known as the 'body' of the candlestick.

Many traders find candlestick charts the most visually appealing when viewing live forex charts. They are also very popular as they provide a variety of price action patterns used by traders all over the world.

1. Candlesticks are easy to interpret, and are a good place for beginners to start figuring out forex chart analysis.

2. Candlesticks are easy to use! Your eyes adapt almost immediately to the information in the bar notation.

3. Candlesticks are good at identifying market turning points – reversals from an uptrend to a downtrend or a downtrend to an uptrend.

*The information presented above is intended for informative and educational purposes, should not be considered as investment advice, or an offer or solicitation for a transaction in any financial instrument and thus should not be treated as such. Past performance is not a reliable indicator of future results.

Online Chat Chat with us

Email:supportsohomarkets.cc

Copyright © 2024 - All rights reserved.

Soho Markets Global Limited is an Investment Firm incorporated under the laws of Republic of Mauritius under number 181778 and registered address at Suite 803, 8th Floor, Hennessy Tower, Pope Hennessy Street,11328, Port Louis, Mauritius. Regulated by the Financial Service Commission (FSC) in Mauritius under license number GB21026599.

RISK WARNING: Soho Markets Global Ltd offers trading on Foreign Exchange (‘Forex or ‘FX) and Contracts for Difference (‘CFDs), which are complex financial products that are traded on margin. They carry a high level of risk since leverage can work both to your advantage and disadvantage. As a result, these products may not be suitable for all investors, as loss of all invested capital may occur. You should not risk more than you are prepared to lose. Before deciding to trade, you need to ensure that you understand the risks involved and consider your investment objectives and level of experience. Seek independent advice, if necessary.

Soho Markets Global Ltd does not issue advice, recommendations or opinions in relation to acquiring, holding or disposing of a CFD.

Soho Markets Global Ltd is not a financial advisor and all services are provided on an execution-only basis. This communication is not an offer or solicitation to enter into a transaction and shall not be construed as such.

This website is not directed at any jurisdiction and is not intended for any use that would be contrary to local law or regulation.

By using our you agree to use our cookies to enhance your experience.

Services are not available for residents of Turkey and United States of America

Telephone: +230 2146398

CLIENT AGREEMENT (TERMS AND CONDITIONS) Complaints or Grievances Policy Conflicts of Interest Policy Cookie Policy Order Execution Policy Privacy Policy Risk Disclosure